Forex day trading offers an exciting opportunity for traders looking to capitalize on short-term price movements in the foreign exchange market. With its inherent volatility and liquidity, the Forex market presents both challenges and opportunities for day traders. In this article, we will explore the fundamentals of Forex day trading, providing strategies, tips, and resources to help traders navigate this fast-paced environment. For additional insights and analysis, you can check out forex day trading ZAR Trading.

Understanding Forex Day Trading

Forex day trading involves the buying and selling of currency pairs within a single trading day, with the aim of profiting from small price fluctuations. Unlike long-term strategies where traders hold onto positions for days, weeks, or months, day traders focus on executing a series of trades throughout the day.

The Forex market operates 24 hours a day, five days a week, allowing traders to engage in their activities at almost any time. However, the most active trading occurs during major market sessions, such as the London and New York sessions, where the bulk of currency transactions take place.

Key Strategies for Forex Day Trading

To be successful in Forex day trading, it’s crucial to develop a solid strategy. Here are some popular strategies used by day traders:

1. Scalping

Scalping is a short-term trading strategy that aims to make small profits on numerous trades throughout the day. Scalpers typically hold positions for only a few seconds to a few minutes, taking advantage of minor price changes. This strategy requires a high level of discipline and quick decision-making, as well as access to a reliable trading platform that supports rapid order execution.

2. Momentum Trading

Momentum trading involves capitalizing on the strength of recent price trends. Traders will look for currency pairs that exhibit strong upward or downward momentum and enter positions in the direction of that momentum. This strategy often requires the use of technical indicators, such as moving averages or the Relative Strength Index (RSI), to identify potential entry and exit points.

3. Range Trading

Range trading is based on the idea that currency pairs tend to trade within specific price ranges. Traders will identify support and resistance levels and place trades based on the expectation that the price will bounce off these levels. This strategy can be effective in stable market conditions, but it may require frequent adjustments as market dynamics change.

4. News Trading

The reaction to economic news releases can create significant volatility in the Forex market. News traders focus on economic events, such as interest rate announcements or employment reports, and aim to profit from the resulting price movements. This strategy requires a strong understanding of how economic data impacts currency values and the ability to react quickly to market conditions.

Risk Management in Forex Day Trading

Effective risk management is vital for successful day trading. Here are several key principles to follow:

1. Set a Risk Tolerance

Determine how much capital you are willing to risk on each trade. A common guideline is to risk no more than 1% of your trading capital on a single trade. This helps prevent significant losses and preserves your trading account over the long term.

2. Utilize Stop-Loss Orders

Stop-loss orders are essential tools that help traders minimize losses. By setting a predetermined exit point for losing trades, you can reduce emotional decision-making and protect your capital. Ensure that your stop-loss levels are based on technical analysis rather than arbitrary numbers.

3. Take Profits Carefully

Just as it is important to limit losses, knowing when to take profits is equally crucial. Some traders prefer to use a risk-reward ratio to determine potential exit points. For example, if you risk 50 pips on a trade, aim to make at least 100 pips in profit, creating a 1:2 risk-reward ratio.

Essential Tools for Forex Day Trading

To enhance your day trading experience, consider using these tools:

1. Trading Platforms

Choose a reliable trading platform that supports rapid order execution and provides real-time market data. Features to look for include advanced charting tools, technical indicators, and a user-friendly interface.

2. Economic Calendars

Stay informed about upcoming economic events by using an economic calendar. This tool provides information about important data releases and their potential impact on the Forex market.

3. Charting Software

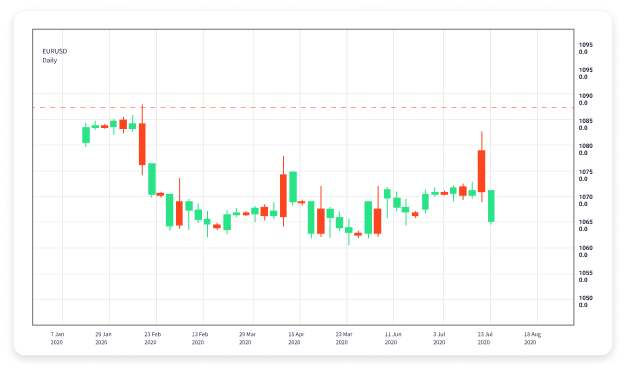

Charting software is essential for technical analysis. Look for platforms that offer various chart types, customizable indicators, and analysis tools to help identify trends and patterns in price movements.

Conclusion

Forex day trading can be a lucrative endeavor for those willing to learn and adapt to market conditions. By understanding key strategies, managing risk effectively, and utilizing the right tools, aspiring traders can navigate the complexities of the Forex market with confidence. Whether you are a beginner or a seasoned trader, continuous education and practice are essential for success in day trading. Happy trading!