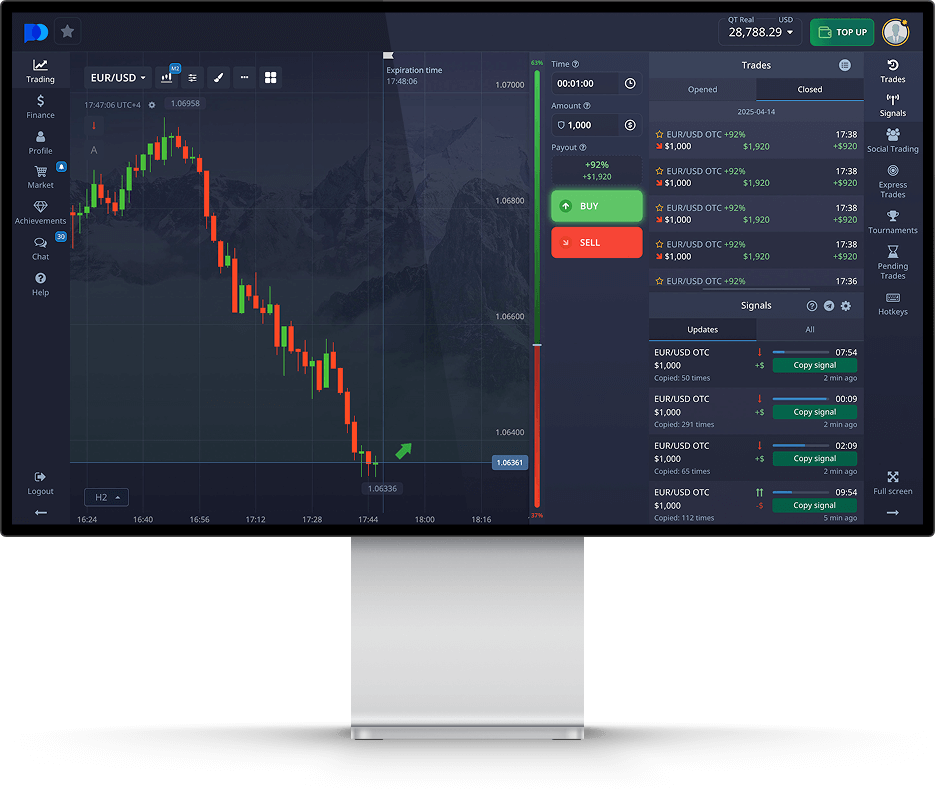

Pocket Option Martingale Method: A Comprehensive Guide

The Pocket Option Martingale Method has gained significant popularity among traders for its unique approach to managing risk and maximizing potential returns. This article delves into the intricacies of the Martingale strategy, how it can be effectively applied on the Pocket Option platform, and the essential considerations you should have in mind before implementing it. For a deeper understanding of this method, you can explore more details [here](https://pocket-option.guide/martingejl/).

Understanding the Martingale Strategy

The Martingale strategy is a betting system that originated in 18th-century France, commonly used in gambling contexts. Its core principle is based on doubling the stake after each loss, with the belief that a win will eventually occur, recouping all previous losses plus a profit equal to the original stake. While it may sound appealing, the Martingale method is not without its risks, especially in trading environments like Pocket Option.

How the Pocket Option Martingale Method Works

When applied to trading on the Pocket Option platform, the Martingale method works similarly to its traditional gambling roots. The trader begins with a predetermined investment amount. If a trade results in a loss, the trader doubles their investment for the next trade. When a win occurs, the trader resets to the original investment amount. This allows for quick recovery of losses, making it an interesting approach for many traders.

Key Steps to Implementing the Martingale Method

- Select a Starting Investment: Determine the amount you are comfortable risking on your initial trade. This should be a small portion of your overall trading capital.

- Choose Your Trading Asset: Select an asset you are familiar with, as knowledge of the asset’s behavior can significantly influence your success.

- Set Your Parameters: Establish your take-profit and stop-loss levels to manage risk effectively.

- Start Trading: Execute your first trade. If the outcome is negative, double your investment for the next trade.

- Reset After a Win: Once you have a successful trade, return to your initial investment amount and repeat the process.

Pros and Cons of the Martingale Method

As with any trading strategy, the Martingale method has its advantages and disadvantages. Here’s a deeper look:

Advantages

- Potential for Quick Recovery: The primary benefit is the ability to quickly recover losses, provided you have sufficient capital.

- Simplicity: The rules are straightforward, making it easy to implement, even for novice traders.

- Psychological Advantage: The method can help reduce the emotional impact of losses, as each win can quickly turn the tide.

Disadvantages

- Risk of Big Losses: If you encounter a losing streak, the amounts of investments can grow exponentially, leading to significant losses.

- Capital Limitations: A trader needs a substantial bankroll to withstand potential drawdowns effectively.

- Market Conditions: The Martingale method can be ineffective or harmful in volatile market conditions where losses are frequent.

Tips for Using the Martingale Method Effectively

To enhance the effectiveness of the Pocket Option Martingale Method, consider these practical tips:

- Limit Your Losses: Set a strict limit to how many trades you’ll make in a row after a loss.

- Use a Demo Account: Practice on a demo account before risking real money to understand how the Martingale method impacts your trading.

- Know When to Walk Away: If you hit your loss limit, it’s essential to stop trading and reassess your strategy.

- Stay Informed: Keep updated on market trends and news that can affect your chosen assets, as this knowledge can help inform your trades.

Conclusion

The Pocket Option Martingale Method can be a viable strategy for traders looking to manage risk and recover losses. However, it is crucial to approach this method with caution. Understanding its principles, potential risks, and limitations is vital for successful implementation. Always combine this strategy with thorough research, risk management practices, and a solid trading plan to increase your chances of success in the dynamic world of trading.